How is Crypto taxed in Malaysia?

Tax matters are the least likely topic I expect to share here. But with Web3, everything is expected to be tradeable with real money. Thus when profits are made, taxes would arise. Sharing views on my country’s specific tax guidelines for everyone’s benefit. Personal opinion and experience stated here should not be considered professional financial investment or legal advice.

A new guideline on taxation of digital currency transactions in Malaysia was released in August 2022. Before this, there was not much documentation on digital currencies. The message before was that digital currencies are not to be used as legal tender. But with these guidelines, it seems that digital currencies are beginning to become more accepted in the country.

The previous guideline (on Taxation of Electronic Commerce Transactions) has stated both “Digital currency” and “Digital token”. But, it was more focused on e-Commerce (Web2) products that are not cryptographically secure. The current guideline focusing on cryptographically secure currency and tokens is a good hint that the Government may seem like they are beginning to accept the use of cryptocurrencies and NFTs.

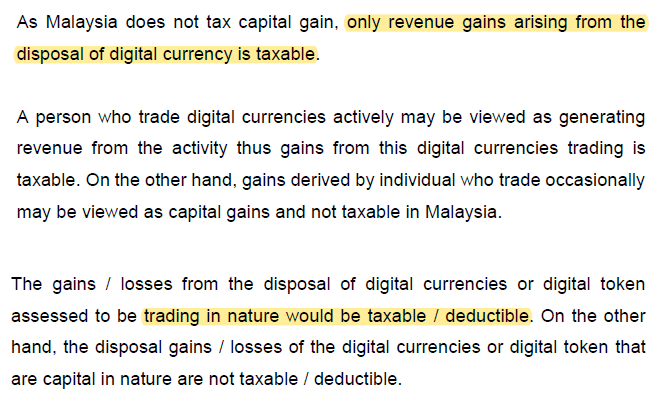

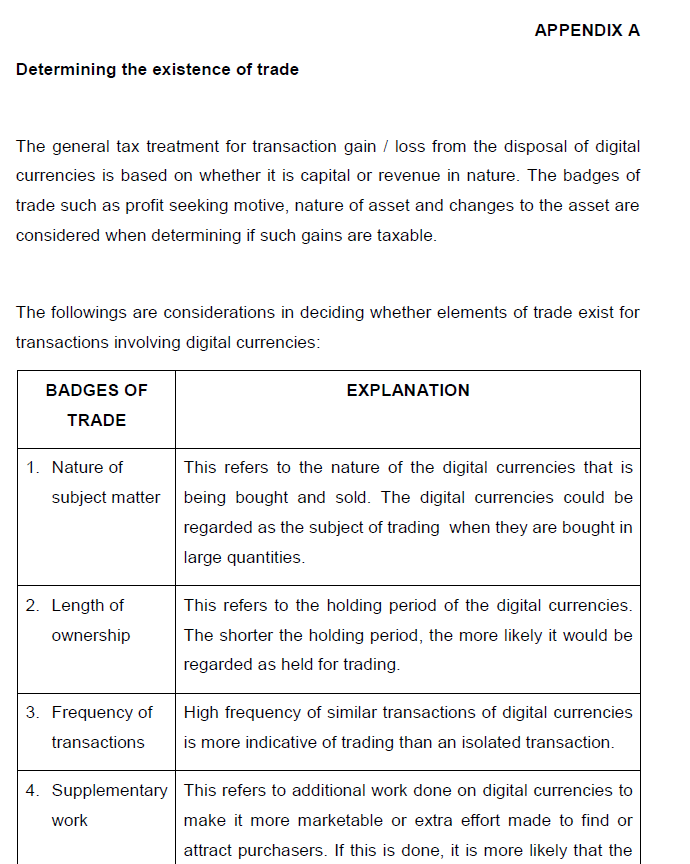

Digital currency is expected to be taxed similarly to stocks. Only gains/losses that are trading in nature will be taxable/deductible. Unlikely for you to be taxed for holding cryptocurrencies and NFTs for long periods and selling infrequently. There is "Appendix A" within the guideline that can help you identify if elements of trade exist for transactions involving digital currencies.

Businesses should record the sale based on the value of the goods/services in RM. It seems better for businesses selling items in digital currency to convert to RM straightaway after sales. This is to minimize foreign exchange losses if dips were to happen. Having Central Bank Digital Currency (CBDC) or Stablecoins legalized for use makes this much easier for business.

Ticket selling transactions were used as an example. It seems that the Government already has a hint of the most likely business applications of digital currencies in the near future.

Paragraph 3.2.2.2 seems to hint that digital currencies can be used to make payments for goods/services. No specific mention of whether it can be considered legal tender, but maybe businesses are already encouraged to accept it as payment.

"Airdrops" and "Hard Forks" was mentioned that it's not considered income and thus not taxed. If a Company residing in (e.g. Pentas.io) decides to airdrop tokens, it is unlikely it'll be taxed. The Ethereum ‘Merge’ hard fork which would duplicate tokens into Proof-of-Stake and Proof-of-Work is also unlikely to be taxed.

There is something to consider if you are providing goods(property)/services in return for an unlisted project token. You will most probably be taxed according to the fair value of the property/services you are providing. Project tokens lower in value than the property/service’s fair value may hinder people from taking payments in unlisted tokens. An exception would only be for those with the perception that in time the value of the project token will rise.

There is an extensive list of records that need to be kept. Wallet keys have been specifically mentioned. This may be a precautionary measure to ensure wallet owners cannot try to avoid tax by declaring the loss of wallet keys. Fines most likely can be imposed if such records are a loss.

One thing I've noticed is that CBDCs/stablecoins are not mentioned at all. Hoping to see the government's views & stance on this in the future. But overall the guideline has covered what most will be used by retail investors using digital currencies.

Comments ()